Business Situation

The firm’s accounting teams were spending a significant portion of their time on manual and repetitive data entry tasks. Invoices were received, key information was extracted, and journal entries were made manually. This workflow limited the team’s ability to focus on higher-value tasks such as financial analysis and client advisory. It also created operational bottlenecks and increased the probability of human error. Large volumes of documents from clients across different industries and regions were handled.

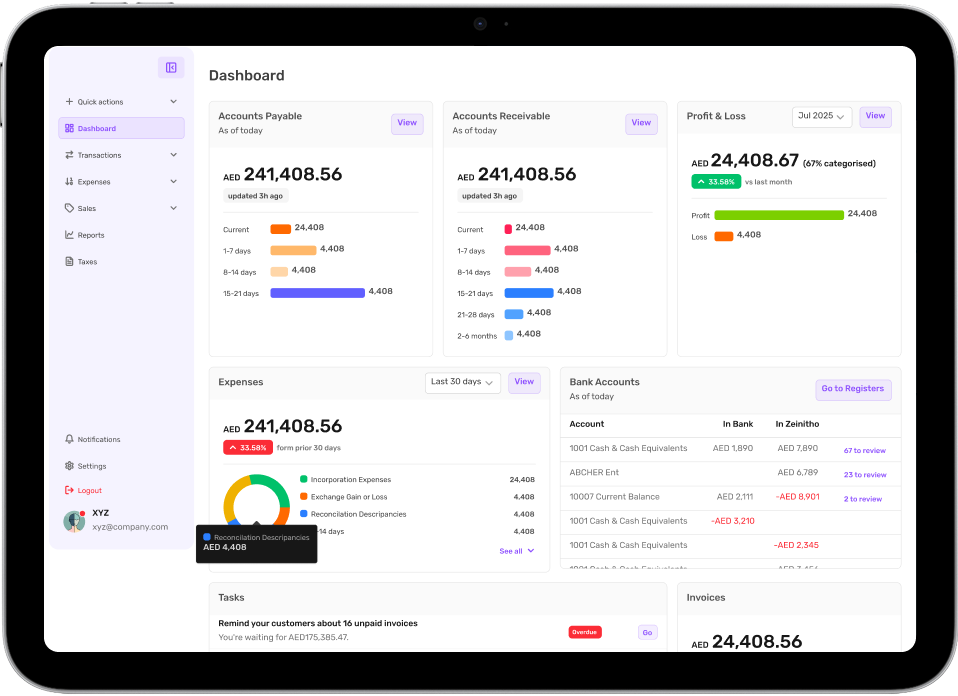

To overcome these inefficiencies, the firm envisioned a centralized, AI-powered platform that automates the entire bookkeeping cycle. Their goal was to create a single source of truth that ingests invoices, intelligently extracts data, and prepares entries for review, freeing expert accountants from mundane tasks. They required a solution that preserves accuracy and oversight through a Human-in-the-Loop model while increasing speed and scalability.

Unthinkable was selected as the technology partner based on its proven expertise in building custom accounting platforms, deep domain understanding of the accounting vertical, and architectural excellence in delivering scalable systems at speed. Backed by a proprietary Architecture Framework and CMMI Level 3–certified processes, Unthinkable builds enterprise-grade platforms that eliminate technical debt, ship faster, and evolve with the business while delivering measurable competitive advantage.

The key requirements included the following:

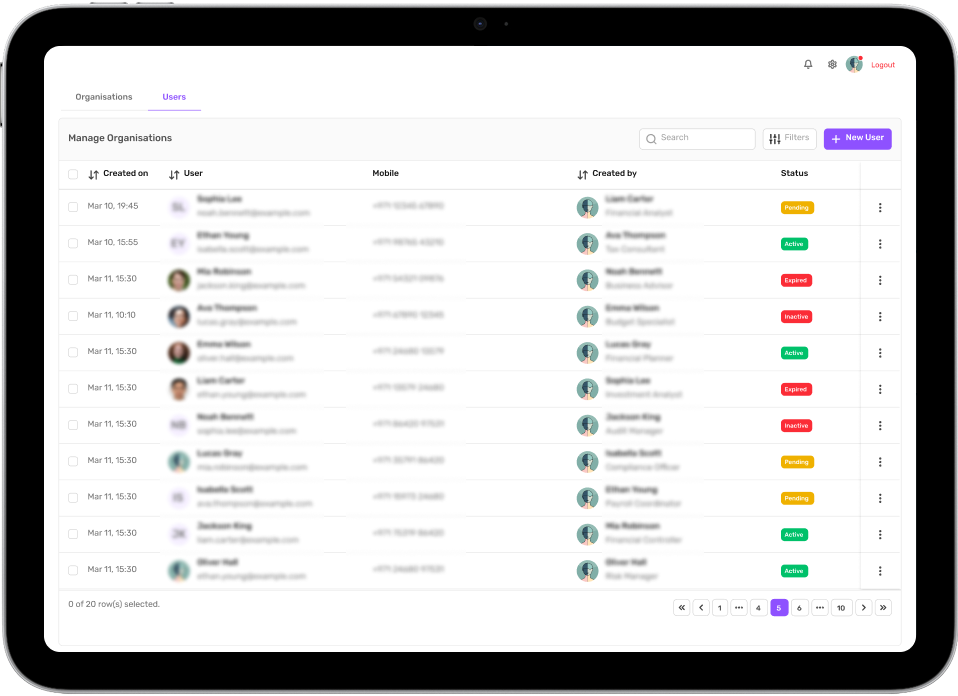

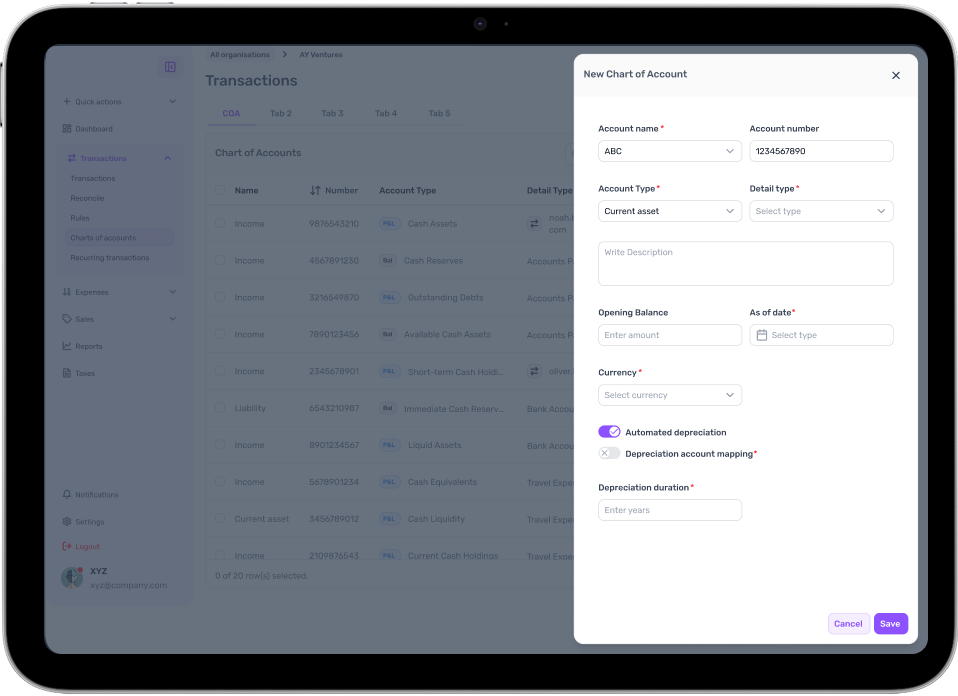

Develop a secure, multi-tenant accounting platform for managing financial operations for multiple end clients, while ensuring strict data segregation and privacy.

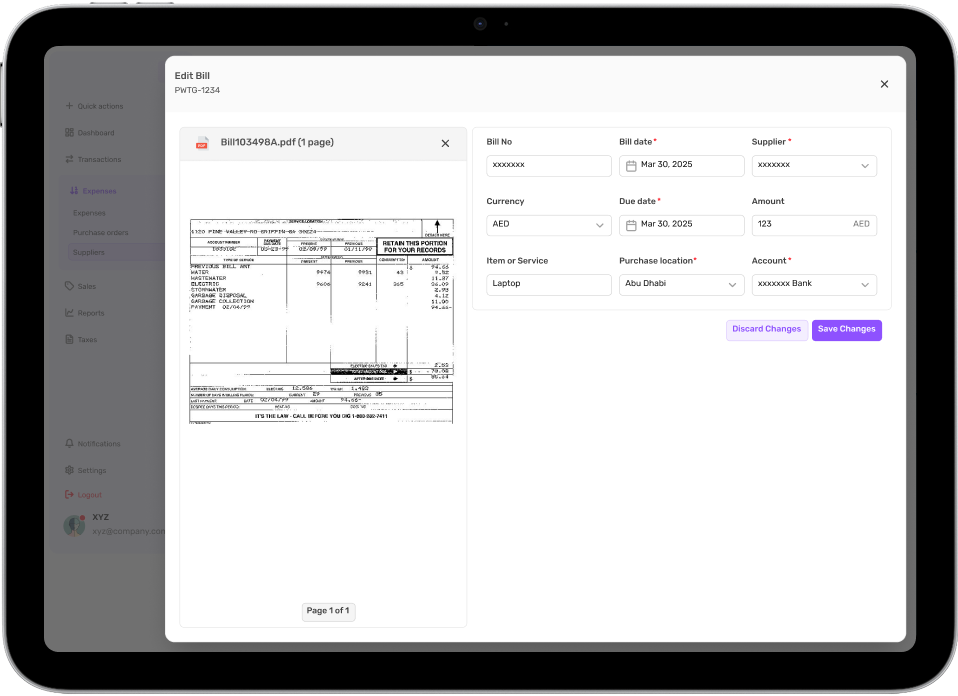

Implement an intelligent data capture mechanism using AI-driven Optical Character Recognition (OCR) and Large Language Models (LLMs) to automate data extraction from scanned invoices.

Enable bulk document uploads to allow accountants to process multiple invoices efficiently within a single workflow.

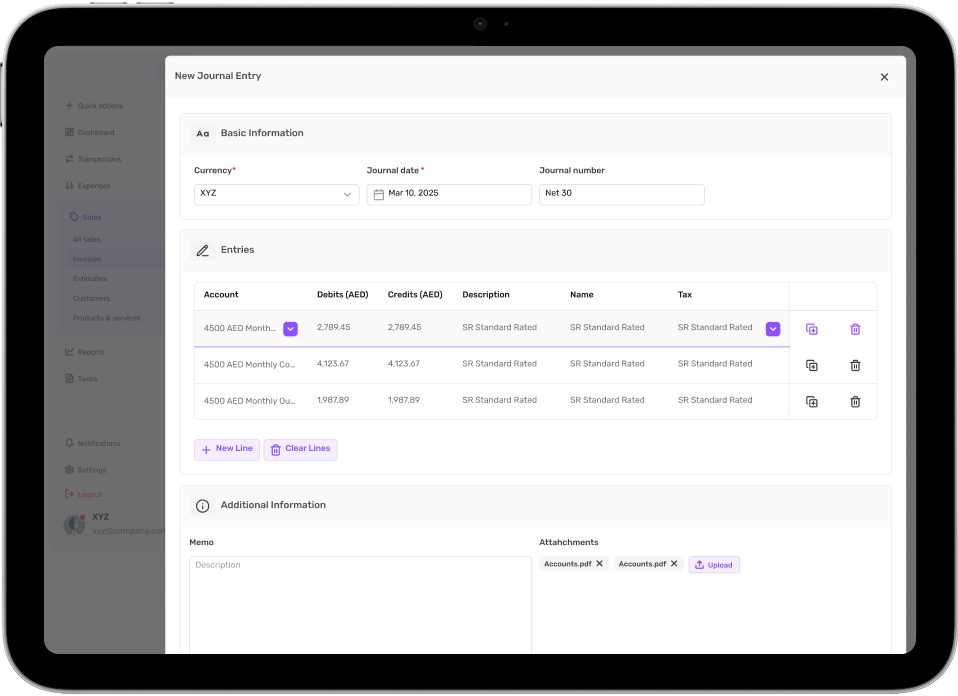

Design a “human-in-the-loop” verification interface to permit quick review and correction of AI-generated data.

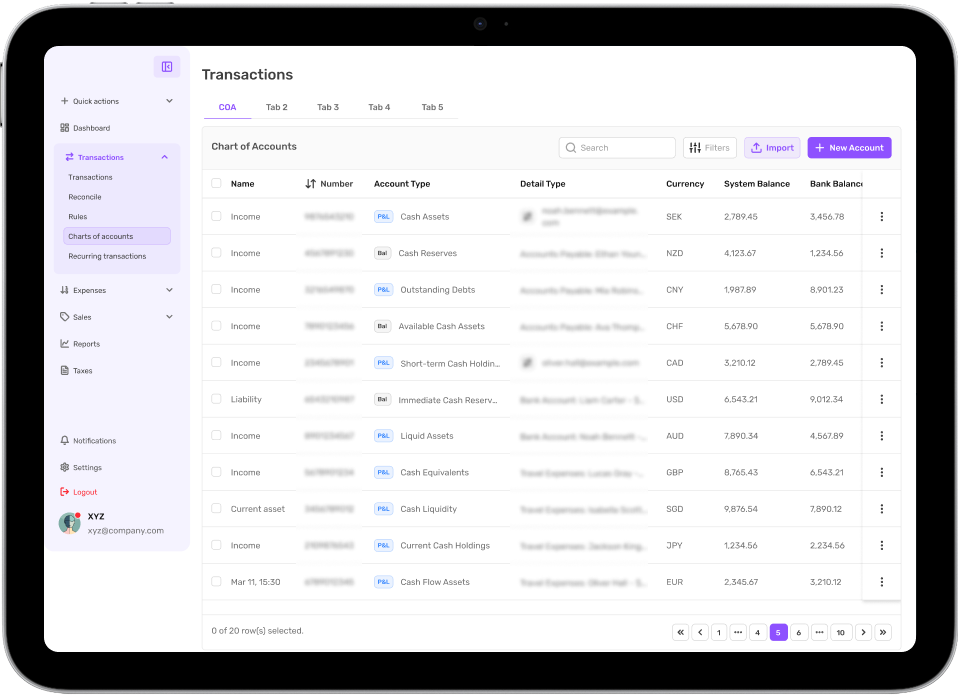

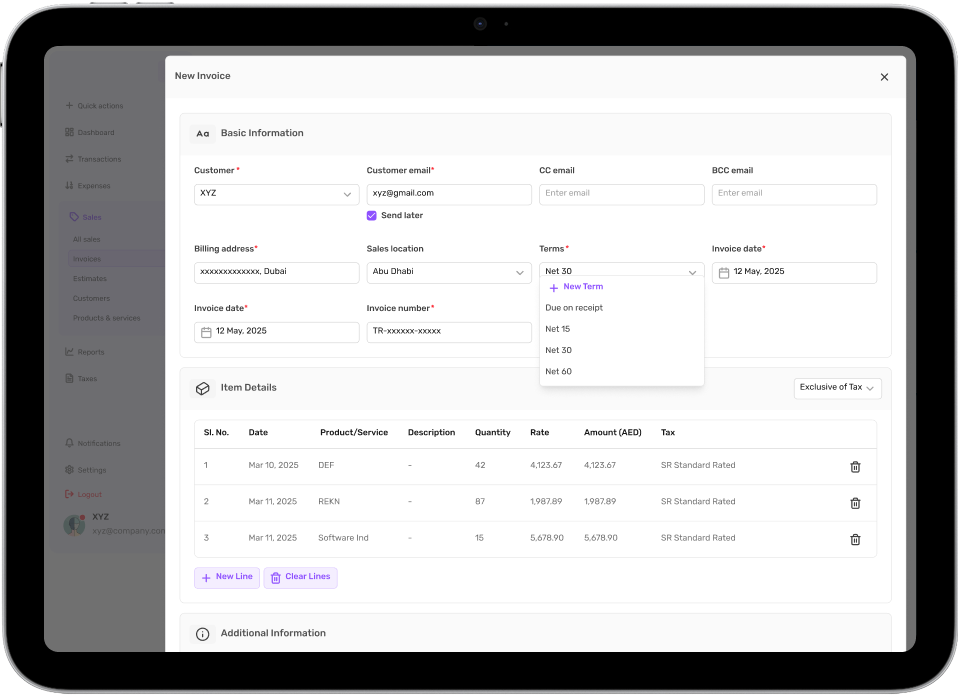

Build a comprehensive set of core accounting functionalities, including accounts payable management and on-demand financial reporting.

Ensure the platform is built on a scalable, future-ready architecture that can support enhancements such as direct banking API integrations.