Business Situation & Requirements

In the health insurance industry, efficient and compliant claim verification is critical yet often operationally complex.

The client had been managing high-stakes injury claims through entirely manual processes, involving the physical transfer and review of radiology records by board-certified specialists. As the organization aimed to scale, reliance on hard-copy records and physical storage created significant bottlenecks, delayed turnaround times, and restricted operational growth.

To overcome these constraints, the client sought to digitize and automate its end-to-end claim verification cycle. The organization required a secure, compliant, and scalable digital platform capable of managing radiology records electronically, streamlining collaboration with specialists, reducing physical dependencies, and ensuring faster claim processing. The client partnered with Unthinkable to design and implement a technology-driven solution that could modernize workflows, improve efficiency, and support long-term scalability.

Key Requirements were:

Conduct a comprehensive discovery and analysis phase to assess existing claim workflows, healthcare partner onboarding journeys, stakeholder responsibilities, scalability bottlenecks, and technology gaps, forming the foundation for a clearly defined digital transformation roadmap.

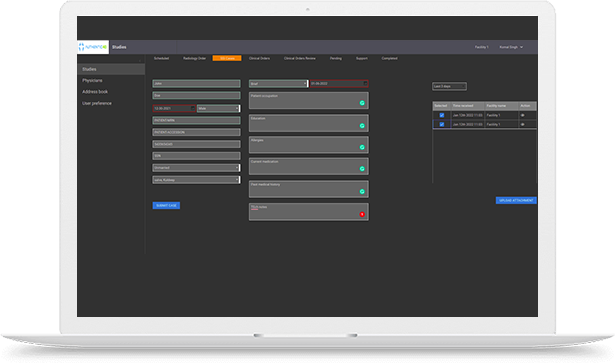

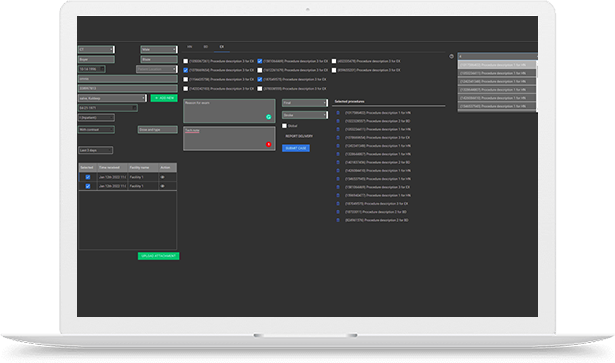

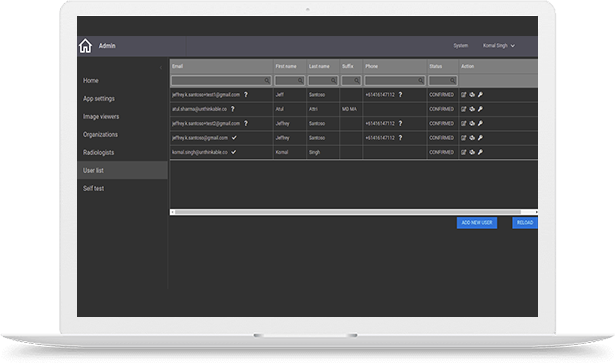

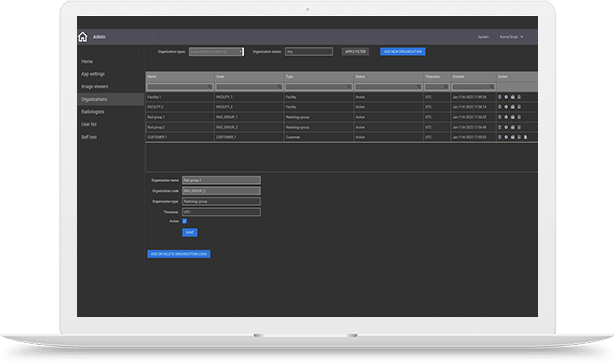

Design and develop an end-to-end digital claims management platform to streamline claim evaluation, healthcare partner onboarding, secure record exchange, and collaboration between insurers, medical reviewers, and administrative teams.

Build an intelligent work management system that automatically assigns claim evaluation cases to radiologists based on availability, specialization, case complexity, and real-time workload balancing to optimize turnaround time and resource utilization.

Architect a scalable and high-performance infrastructure capable of supporting a tenfold increase in medical record processing capacity, ensuring reliability, fault tolerance, and seamless handling of growing claim volumes.

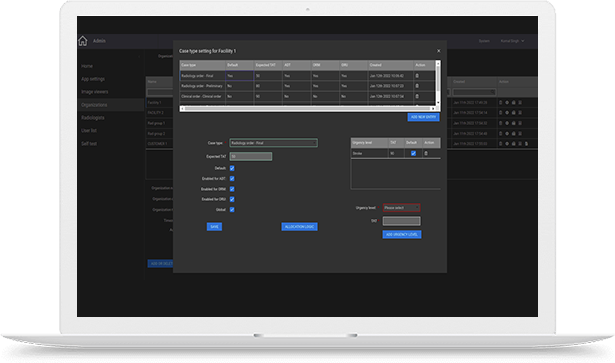

Enable configurable rule engines and workflow automation to accommodate diverse operational policies, compliance mandates, and approval hierarchies for each onboarded healthcare organization without requiring major system changes.

Ensure HIPAA-compliant data handling with end-to-end encryption, role-based access controls, secure audit trails, and real-time process transparency through status tracking, dashboards, and analytics to reduce claim lifecycle time and improve overall productivity.