Business Situation & Requirements

As digital payments become central to everyday commerce, PoS solution providers are challenged to balance speed, reliability, and cost efficiency while maintaining strong merchant–customer relationships. Any inefficiency in payment processing or transaction management can impact merchant confidence and delay returns.

To address these challenges and enhance its unified cloud-based payment platform, the client partnered with Unthinkable to modernize its existing system. The legacy platform lacked capabilities for offline transaction record-keeping, efficient sorting, and quick retrieval of records. Additionally, there was no clear segregation of bank offers, and the scheme approval workflow was fragmented. The client required a scalable, well-structured solution to streamline payment operations, improve data management, and enable faster, more reliable transaction processing.

Key requirements:

Conduct a comprehensive discovery phase to brainstorm, analyze existing workflows, and identify gaps in online and offline transaction handling.

Design a simple yet robust infrastructure to audit, sync, and reconcile online and offline transaction histories seamlessly.

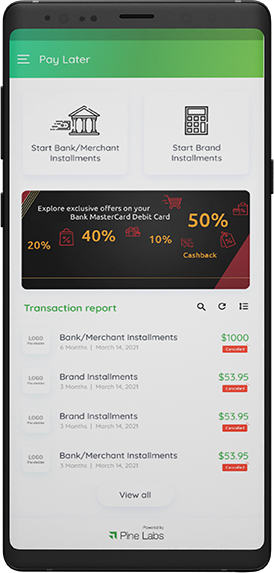

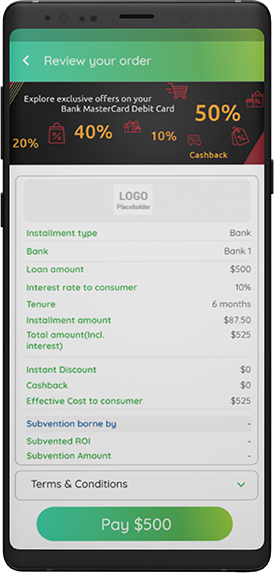

Enable proper and detailed grouping of bank schemes with accurate mapping across payment workflows.

Maintain a clear bifurcation between transaction servicing and transaction reconciliation to ensure operational clarity.

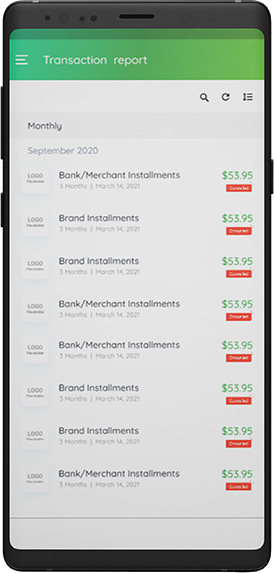

Implement reliable, high-performance sorting and advanced search capabilities for transaction records.

Integrate a modern, scalable database to support efficient data storage, fast retrieval, and long-term data integrity.