Business Situation and Requirements

With an increasing volume of sensitive documents, FAB recognized the need to modernize its legacy DMS to improve performance and security. Thousands of critical records, including personal banking information, were being scanned and stored manually, resulting in inefficiencies and highlighting the need for a modern, secure, and scalable solution.

These challenges were amplified by limitations in the existing system, which was built on outdated technologies such as Documentum 6.5 and Captiva 6.0. The system supported only a limited range of document types, had slow scanning and indexing processes, and lacked a reliable backup or disaster recovery mechanism in the event of a data center failure.

Leveraging our extensive experience in modernizing legacy Document Management Systems, Unthinkable was chosen as FAB’s technology partner.

Their key requirements included:

Upgrade Core Technologies – Replace the outdated scanning and indexing systems with modern, supported technologies to improve speed, reliability, and maintainability.

Streamline Document-Intensive Processes – Optimize banking workflows to handle high volumes of documents efficiently, reducing manual effort and processing time.

Implement Disaster Recovery (DR) Site – Set up a backup infrastructure to ensure business continuity and rapid recovery in case of system failures or data center issues.

Expand Document Compatibility – Enable the system to support a wider range of document types, accommodating diverse banking records and formats.

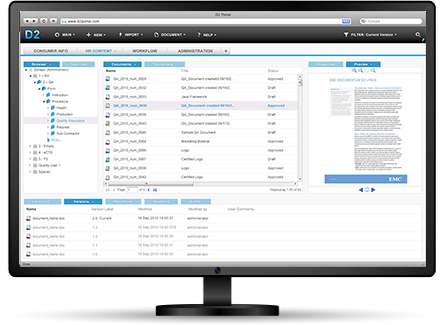

Role-Based Access Control – Organize the system so users have permissions based on their role, ensuring security and compliance while allowing authorized access.

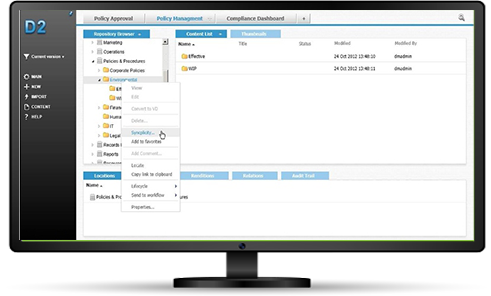

Enhance System Organization and Navigation – Improve the document management interface and structure for faster search, retrieval, and overall usability for banking staff.